In retail, cash doesn’t flow — it floods, trickles, and sometimes disappears altogether. For CFOs managing consumer-facing, inventory-heavy businesses, liquidity is both a strategic weapon and a daily survival game. Between inventory commitments, delayed marketplace settlements, and volatile demand cycles, retail finance leaders are often steering their organizations through a Rubik’s Cube of timing mismatches, margin leakage, and data latency.

This guide unpacks the structural causes of retail cash flow volatility — and more importantly, outlines how modern CFOs are regaining control. Whether you’re managing omnichannel operations or scaling a fast-moving DTC brand, you’ll find frameworks and tactics to help navigate the complexity with clarity.

Why Retail Cash Flow Is Uniquely Volatile

A CFO Problem Defined by Timing, Complexity, and Thin Margins

Retail isn’t just about moving products — it’s about moving cash through a high-friction system riddled with delays, dependencies, and distortions.

Unlike software or service businesses, retailers often face:

- Upfront inventory costs, with suppliers requiring payment 30–90 days before goods are sold.

- Long cash conversion cycles, where inventory sits in warehouses or storefronts before generating revenue.

- Multi-party friction, with payments touching suppliers, manufacturers, freight providers, 3PLs, payment processors, marketplaces, and returns platforms.

The result? CFOs must manage liquidity across a multi-node, delay-prone system while forecasting demand with imperfect data.

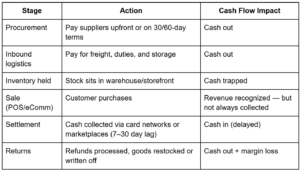

Retail Cash Flow Anatomy: The Transaction Timing Trap

In short: you pay now, get paid later, and often not the amount you expected.

The CFO Challenge: See Around Corners in a Multi-Variable System

Traditional accounting and BI tools can’t keep up with the real-time nature of modern retail. By the time books close, the next liquidity crunch may already be unfolding.

What’s needed is a financial operating model that:

- Connects cash flow to inventory velocity and payment cycle data

- Incorporates real-time settlement, returns, and chargeback signals

- Enables rolling forecasts that flex with daily operational shifts

In the following sections, we’ll dive deeper into how inventory decisions, seasonal pressures, and system-wide data gaps impact cash — and how top-performing CFOs are building resilience with automation, forecasting, and smarter operating rhythms.

The Inventory Trap: When Working Capital Becomes Sunk Capital

Inventory: The CFO’s Most Expensive Blind Spot

Inventory doesn’t just tie up cash — it distorts financial reality across the P&L, balance sheet, and even FP&A models. It sits at the intersection of operations, marketing, and finance — yet is often owned by none of them with true accountability.

For retail CFOs, the real danger is this: inventory decisions made in isolation ripple across liquidity, gross margins, and scenario viability. Misalignments in inventory-to-cash timing can quietly sabotage working capital health even in revenue-growth quarters.

“You don’t feel an inventory decision when it’s made — you feel it two quarters later when the markdowns and cash gaps hit.”

Strategic Risk: When Speed Kills Liquidity

Faster product cycles, tighter vendor lead times, and DTC launch velocity have created a cultural bias toward speed — but the finance function often absorbs the consequences:

- Excess POs placed to avoid stockouts, but without SKU-level GMROII clarity

- Upfront payments to overseas suppliers, locking cash long before revenue recognition

- Campaign-led demand surges that outpace inventory replenishment logic or mismatch with payment settlement windows

Finance leaders must model not just inventory value, but the timing and recoverability of that cash.

Root Causes of Cash Drain from Inventory

- SKU Proliferation Without Portfolio Yield Analysis

More SKUs mean more stranded capital unless each is evaluated for:- Forecast accuracy

- Return rate

- Markdown exposure

- Seasonality elasticity

- Static Reordering Policies

Many retailers still reorder based on rigid thresholds, not sell-through velocity adjusted for returns and lead time variability. - Disconnected Cash Planning

Inventory purchases are often executed based on merchandising plans — not integrated with treasury’s liquidity forecasts or the real-time burn rate. - Post-Launch Drift

Launch-day sales may outperform, but replenishment cycles often ignore ad spend lag, return windows, and payment processor settlement delays — distorting working capital assumptions in Q+1.

CFO Playbook: From Inventory Sunk Cost to Strategic Liquidity Lever

🔹 Forecast cash impact of inventory at SKU cluster level, not just total units

→ Build SKU groupings by contribution margin × turn velocity × return rate

🔹 Tag inventory by “cash recoverability” status

→ Real-time classification: fast-turn / markdown-risk / dead stock

→ Adjust forecasted liquidity buffers accordingly

🔹 Incentivize merchandising on GMROII, not top-line

→ Align team KPIs with finance KPIs: margin × velocity > revenue only

🔹 Model inventory buys as CapEx-style cash deployment

→ Treat major PO events like you would a CapEx investment — with ROI modeling, ramp time, and risk-adjusted yield assumptions

Metrics That Matter (If Measured Correctly)

- Days Inventory Outstanding (DIO): But segmented by product class — not averaged across channels

- Gross Margin Return on Inventory Investment (GMROII): Must be net of returns, promos, and fulfillment leakage

- Inventory-to-Sales Ratio: Watch deltas in product launches vs. core SKUs — signal for product strategy inefficiency

- SKU-Level Sell-through: When tied to cash collection timing, becomes the CFO’s best early warning system

Boardroom Questions CFOs Should Be Asking

- Which 15% of our SKUs consume 60% of our inventory cash — and do they deliver proportional margin?

- How many weeks of inventory is truly “convertible” in the next 30–60 days — after accounting for returns, markdowns, and channel latency?

- Is our inventory strategy accounting for FX risk, supplier dependency, and ad spend variability — or are we treating all SKUs as equally liquid?

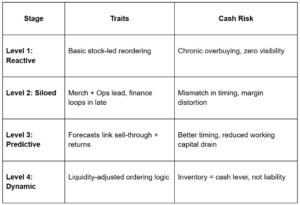

Maturity Model: Inventory-to-Cash Resilience

Inventory Isn’t Just a Supply Chain Lever — It’s a Financial Design Choice

Inventory is strategy. And in retail, it’s the biggest test of a CFO’s ability to connect operations, timing, and capital efficiency.

If your systems treat inventory as a physical logistics issue rather than a cash orchestration challenge, you’re not just leaving margin on the table — you’re tying liquidity to a bet you can’t hedge.

Managing Seasonality: Turning Spikes into Strategic Advantage

Seasonality: The Predictable Pattern That Still Wrecks Liquidity

Retail’s calendar doesn’t flow — it surges. Holidays, back-to-school, end-of-season promos, and regional sales events create predictable demand spikes. But while revenue cycles may be seasonal, cash demands are not neatly aligned.

What looks like seasonality on the P&L often shows up as liquidity stress on the balance sheet — weeks or even months before the sales peak. That’s because pre-season cash burn is front-loaded into inventory purchases, supplier payments, freight, storage, and marketing — all before revenue lands.

“Seasonality isn’t a sales forecast problem — it’s a cash choreography problem.”

Why Seasonality Cracks the Forecast

CFOs often operate with decent sales forecasts, but inaccurate cash flow models during seasonal surges. Why?

- Pre-Spike CapEx Masquerading as Opex

- Prepayments for large POs, seasonal hiring, warehousing — none of which scale linearly

- These costs distort liquidity forecasts unless treated like strategic pre-deployments of cash

- Return and Refund Delays Lag Behind Sales

- Post-season, returns surge — but most cash forecasts assume net revenue at POS, not post-return reality

- Delayed Settlements Create Mid-Season Liquidity Gaps

- Marketplaces may hold funds during high-risk periods (e.g. BFCM returns buffer)

- Card processors may delay payouts or increase reserves — while vendors still expect payment on Day 30

- Sales-Merch-Marketing-Finance Disconnect

- Campaign calendars are often locked before finance sees the working capital runway

- Paid media spend outpaces visibility into incremental cash impact

CFO Playbook: De-Risking Seasonality With Cash-Centric Planning

🔹 Pre-season liquidity simulations, not just revenue planning

→ Model not just revenue lift, but:

- Gross margin variability

- Refund rates

- Average settlement lags by channel

🔹 Align PO releases with updated demand elasticities

→ Use AI demand models to adjust buys every 2–4 weeks, not locked 3 months out

🔹 Pre-fund working capital with dynamic credit options

→ Revenue-based financing or inventory-specific credit lines (e.g., Clearco, Wayflyer) can preserve general liquidity

🔹 Integrate return rate modeling into DSO assumptions

→ Avoid forecasting cash receipts on pre-refund revenue

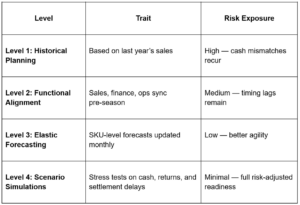

Maturity Model: Seasonality Cash Resilience

Metrics and Models: The CFO’s Seasonal Toolkit

- Cash Flow at Risk (CFaR): Probabilistic view of worst-case liquidity drawdowns

- Return Adjusted Revenue Forecast (RARF): Forecast revenue minus forecasted returns by SKU class

- Prepaid Cash Coverage Ratio: Days of expected revenue covered by pre-season cash outflows

- Post-Peak Payables Cushion: Buffer needed if settlement lags exceed receivables timeline

Boardroom Questions CFOs Should Be Asking

- What’s our seasonal liquidity exposure — defined as cash out before expected cash in?

- Have we modeled best, median, and worst-case refund rates — and layered that into our collections forecast?

- What percentage of peak season revenue is dependent on marketplaces or platforms that delay cash settlement?

- Are we treating campaign calendars as marketing events — or financial risk events?

Strategic Framing: Seasonality Is a Capital Deployment Game

Seasonality punishes CFOs who forecast revenue — and rewards those who forecast recoverable cash.

This isn’t just about managing volatility. It’s about using seasonal spikes to your advantage — deploying capital into high-yield moments while protecting against extended payment gaps. The best CFOs don’t fear Q4; they underwrite it like a portfolio — scenario-modeled, risk-weighted, and cash-buffered.

CFO Red Flags: Margin Leakage, Reconciliation Delays, and Data Latency

Margin Erosion Rarely Shows Up on the P&L — It Hides in the System

Retail CFOs don’t lose sleep over headline revenue. They lose sleep over where the margin went.

The illusion of profitability can persist for weeks or months if data lags, reconciliation is manual, or systems don’t connect. By the time variance shows up in actuals, the damage has already compounded.

“Revenue shows up in dashboards. Margin shows up in bank balances. Reconciled, late.”

Hidden Margin Killers in the Retail Finance Stack

- Returns Processed Outside the Forecast Window

- Returns often spike post-promo or post-holiday — but many finance models net them against revenue after the fact

- This creates a temporary but dangerous overstatement of cash and margin

- Payment Processor and Marketplace Fees Under-Tracked

- Fees vary by geography, payment method, promo, and dispute volume — but finance often uses blended averages

- Margin gets eroded silently as variable fees aren’t captured SKU- or channel-level

- Chargebacks and Disputes Booked to “Other”

- Inadequate GL tagging creates black boxes in accounting — undermining both root cause analysis and margin clarity

- Discounts Applied by Ops or Customer Success — Not Modeled

- Ad-hoc or tiered discounts are rarely synced with real-time margin impact

- CFOs see only topline boost, not the unit economics decay underneath

Data Latency: The Real-Time Visibility Mirage

The modern CFO stack often looks real-time — but isn’t.

- ERP close cycles lag by weeks

- POS systems don’t reconcile with returns data in-flight

- Marketplace settlements don’t reflect true net receipts until after reconciliation

This means cash forecasting, margin analysis, and payment planning are often driven by stale or incomplete data — leading to costly missteps in liquidity and strategy.

CFO Playbook: Unmasking the Margin Killers

🔹 Map revenue flow from order to cash-in-bank

→ Visualize each stage: POS > returns > shipping > gateway > fees > net settlement

🔹 Establish a Margin Attribution Framework by Channel + Payment Method

→ Disaggregate margin by:

- Promo vs. full price

- Shopify vs. Amazon vs. retail

- Card vs. UPI vs. BNPL

🔹 Automate reconciliation across systems (ERP + POS + gateway)

→ Use middleware or platforms like Tesorio, Modern Treasury, or Tipalti to match POs, invoices, and cash movement in near-real time

🔹 Implement “Cash Reality Checks” on forecast deltas

→ Compare expected cash vs. actual net receipts weekly — flag + investigate >5% variance

Metrics to Monitor — or Miss at Your Peril

- Margin Variance by Channel: Actual vs. modeled margin after netting fees, refunds, and discounts

- Cash Application Lag: Days between transaction and cash settlement in system of record

- Reconciliation Cycle Time: Days to match cash, invoice, and shipment data

- Return-Adjusted Gross Margin: Margin net of forecasted vs. actual returns

Boardroom Questions CFOs Should Be Asking

- Do we know our true net margin — by channel, by payment method, by customer segment?

- How long does it take us to reconcile a transaction from sale to cash realization?

- Which revenue sources have the highest variance between forecasted and actual margin? Why?

- What’s the financial impact of data latency in our core systems (e.g., ERP vs. POS vs. warehouse)?

Strategic Framing: Reconciliation Is Not Accounting — It’s Revenue Defense

CFOs who treat reconciliation as back-office hygiene will miss systemic cash leaks. Those who treat it as a revenue validation system will spot risk early, attribute correctly, and forecast with confidence.

In a transaction-heavy, multi-party retail system, cash rarely leaks in one big break. It evaporates drip by drip — via micro-fees, delayed settlements, poorly classified returns, and silent discounts.

Your job isn’t just to count revenue. It’s to defend it.

Tools, Tactics, and the Modern Retail CFO Tech Stack

Liquidity Isn’t a Report — It’s a Real-Time System

For today’s CFO, visibility into cash isn’t enough. The real unlock is orchestration — automating, predicting, and rebalancing cash across vendors, channels, and operating timelines in real time.

But the typical finance stack still lags:

- ERPs designed for compliance, not agility

- BI dashboards built for post-mortem reporting

- Disconnected systems across POS, warehouse, returns, and payments

To manage retail cash flow proactively, CFOs need a connected, composable tech stack — built for transaction density, margin complexity, and timing mismatches.

“The CFO’s tech stack shouldn’t just describe the business. It should control the business.”

Core Capabilities of a Cash-Aware Retail Finance Stack

✅ Real-Time Bank Reconciliation

→ Every transaction matched daily — by channel, by SKU, by payment method

✅ Dynamic Forecasting Engine

→ Forecasts update automatically with daily order data, returns, and actuals

✅ Inventory-to-Cash Integration

→ PO logic, lead times, and sell-through velocity influence cash runway models

✅ Receivables Prioritization and Settlement Mapping

→ View when and how each $ of revenue becomes bankable cash

✅ Automation of High-Friction Workflows

→ Invoice matching, exception handling, FX normalization — all rules-driven

CFO Playbook: Systems that Enable Cash Flow Agility

🔹 Map your “cash velocity” per system

→ Where does cash originate (POS, Shopify, Amazon)?

→ Where does it move (payment gateways, processors, banks)?

→ How is it tracked (ERP, FP&A tools, Excel)?

🔹 Build an API-first finance data layer

→ Integrate ERP, warehouse, bank, CRM, and returns data into a real-time BI layer (e.g., Snowflake + dbt + Tableau)

🔹 Automate reconciliation across 3 core nodes:

- Order → Fulfillment

- Invoice → Cash

- Return → Refund

→ Use tools like Modern Treasury, Tipalti, Airbase, or embedded finance APIs

🔹 Implement rolling liquidity forecasts across a 13-week horizon

→ Update forecasts weekly, incorporating actuals, PO changes, and demand surges

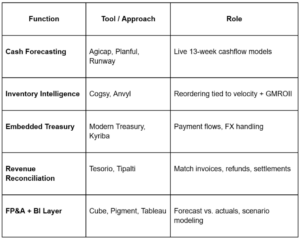

Best-in-Class Retail CFO Stack: Archetype Examples

Boardroom Questions CFOs Should Be Asking

- Do we have a single view of all cash commitments (POs, debt service, marketing spend) in the next 13 weeks?

- Which tools today help us manage cash-in-motion — not just cash-at-rest?

- How much of our cash forecasting is automated, real-time, and connected to live operational data?

- Where do we still rely on manual reconciliation or Excel shadow models?

Strategic Framing: The Retail CFO Is Now the Finance Architect

The future of cash flow management in retail isn’t in better spreadsheets. It’s in system design — connecting the dots between margin visibility, payment velocity, and scenario readiness.

Modern CFOs are building for:

- Speed to insight

- Reconciliation as a service layer

- Forecasts that flex with ops reality

- Cash models that update with every transaction, refund, and promo

Finance has become an engineering problem. And those who build correctly — win sustainably.

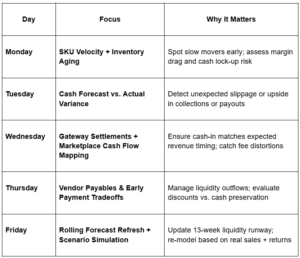

The Retail CFO Weekly Liquidity Operating Rhythm

Why Cadence Beats Catch-Up

In retail, where inventory moves daily and settlements can lag weeks, waiting for the monthly close is a liability. The most effective CFOs run finance like a real-time control tower — with short-cycle reviews that surface risks early and allow mid-quarter course corrections.

“A 1% cash insight on Monday is worth more than a 10% variance analysis next quarter.”

The Weekly CFO Liquidity Cadence

Tooling Enablers:

- Automated daily feeds from POS, ERP, and banks

- Variance dashboards (Planful, Cube, or even Airtable + Looker for lean teams)

- Slack alerts for when actual cash or margin deviates >5% from forecast

- Scenario triggers (e.g., run Q4 downside if BFCM revenue dips 10%)

Boardroom-Level Add-On:

Create a “CFO Liquidity Scorecard” shared weekly with founders/board/execs:

- Cash runway (weeks)

- % of inventory at risk (slow-moving + >60 days)

- Forecast accuracy delta (weekly)

- Net margin variance (by channel)

Conclusion: The Agile CFO in the Age of Retail Complexity

Retail cash flow management is no longer about keeping books clean. It’s about building real-time financial reflexes — across systems, vendors, and operations. It’s the CFO’s job to translate high-velocity business motion into high-precision financial clarity.

In transaction-dense, seasonally volatile businesses, CFOs must shift from:

- Reporting → Orchestration

- Accounting for liquidity → Designing for it

- Looking backward → Modeling multiple futures in real time

The future of finance in retail belongs to leaders who engineer liquidity like infrastructure — anticipating friction, preempting risk, and automating response.

“Cash flow mastery isn’t a finance strategy. It is the strategy.”

July 11, 2025

July 11, 2025