Transaction Value Processed

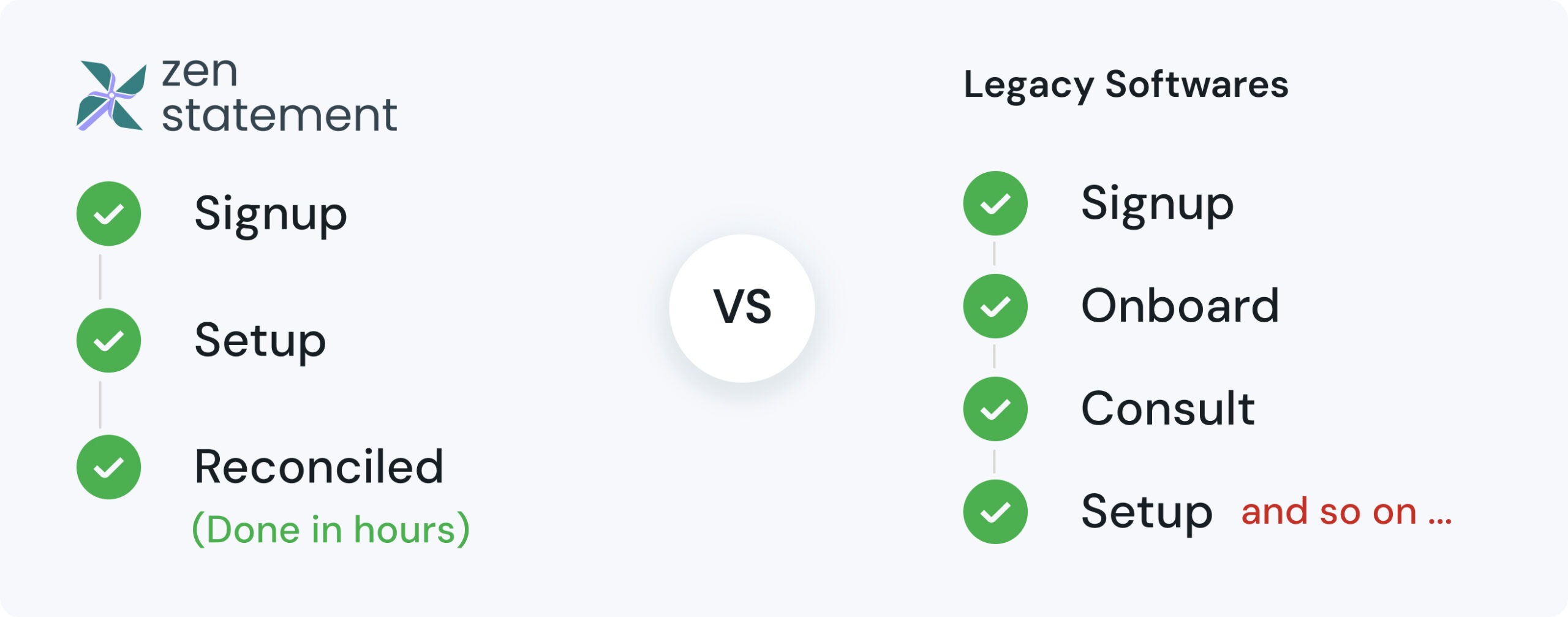

Legacy Systems don’t talk to each other, and manual processes are slowing your finance team down. It’s time to move beyond fragmented workflows and embrace smarter automation.

Centralize and standardize all your financial data in one integrated platform, providing a comprehensive, accurate, and unified view of your finances—ensuring consistency across every financial operation

Gain deep insight into your revenue, cash flow, P&L, and key metrics with our advanced Business Analytics platform. Uncover hidden financial leakages and make data-driven decisions that protect and grow your margins

Automate complex finance processes to eliminate manual errors, streamline operations, and empower smarter, faster decision-making across your business

Optimize your finance operations to drive greater efficiency and profitability. Streamline workflows, eliminate bottlenecks, and integrate systems to create a more powerful, agile commercial engine that accelerates business growth

Centralize and standardize all your financial data in one integrated platform, providing a comprehensive, accurate, and unified view of your finances—ensuring consistency across every financial operation

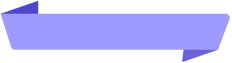

Gain deep insight into your revenue, cash flow, P&L, and key metrics with our advanced Business Analytics platform. Uncover hidden financial leakages and make data-driven decisions that protect and grow your margins

Automate complex finance processes to eliminate manual errors, streamline operations, and empower smarter, faster decision-making across your business

Optimize your finance operations to drive greater efficiency and profitability. Streamline workflows, eliminate bottlenecks, and integrate systems to create a more powerful, agile commercial engine that accelerates business growth

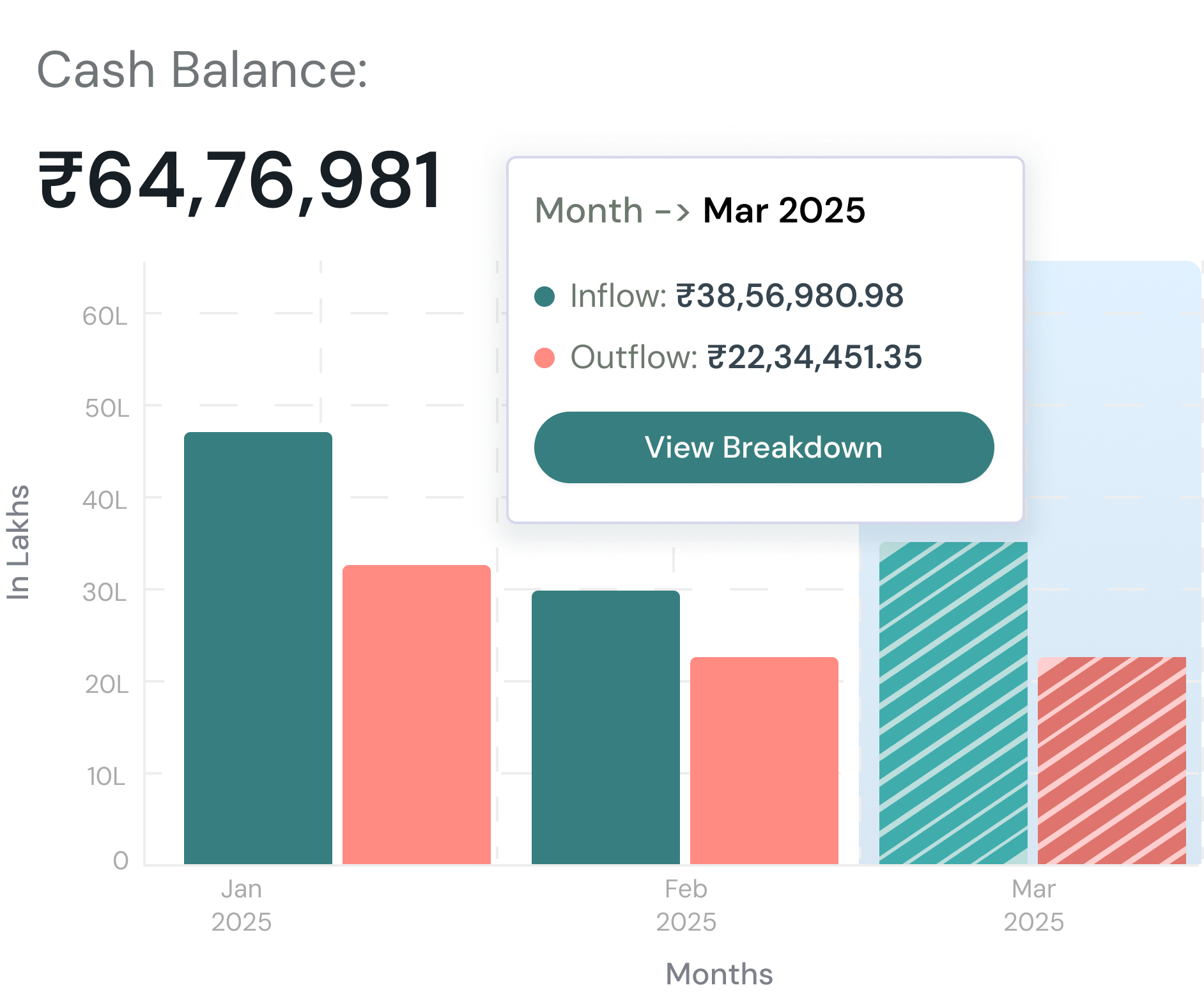

ZenStatement’s AI platform delivers actionable recommendations and insights, simplifying complex finance processes.

Collection Management

Collection Management

Purpose-built for teams handling high volume revenue streams and complex order-to-cash workflows. Gain complete clarity over collections, ensure accurate revenue tracking, eliminate discrepancies, and accelerate cash flow

Payout Management

Payout Management

Managing complex payouts with high deductions across e-commerce and logistics can stretch your margins thin. Protect those margins with better validation and automation that ensure every payout is accurate, streamlined, and optimized

Cashflow Management

Cashflow Management

Enhance your cash flow management with real-time insights and accurate forecasting. Eliminate manual processes, proactively identify gaps, and optimise your financial operations to ensure better control and sustainable growth

A one-stop solution for managing all your finance operations, tailored for high-volume businesses

Designed for high-volume businesses, ensuring scalability and reliability at every stage

Unlike legacy solutions, ZenStatement is quicker and easier to implement, reducing high implementation times and overhead

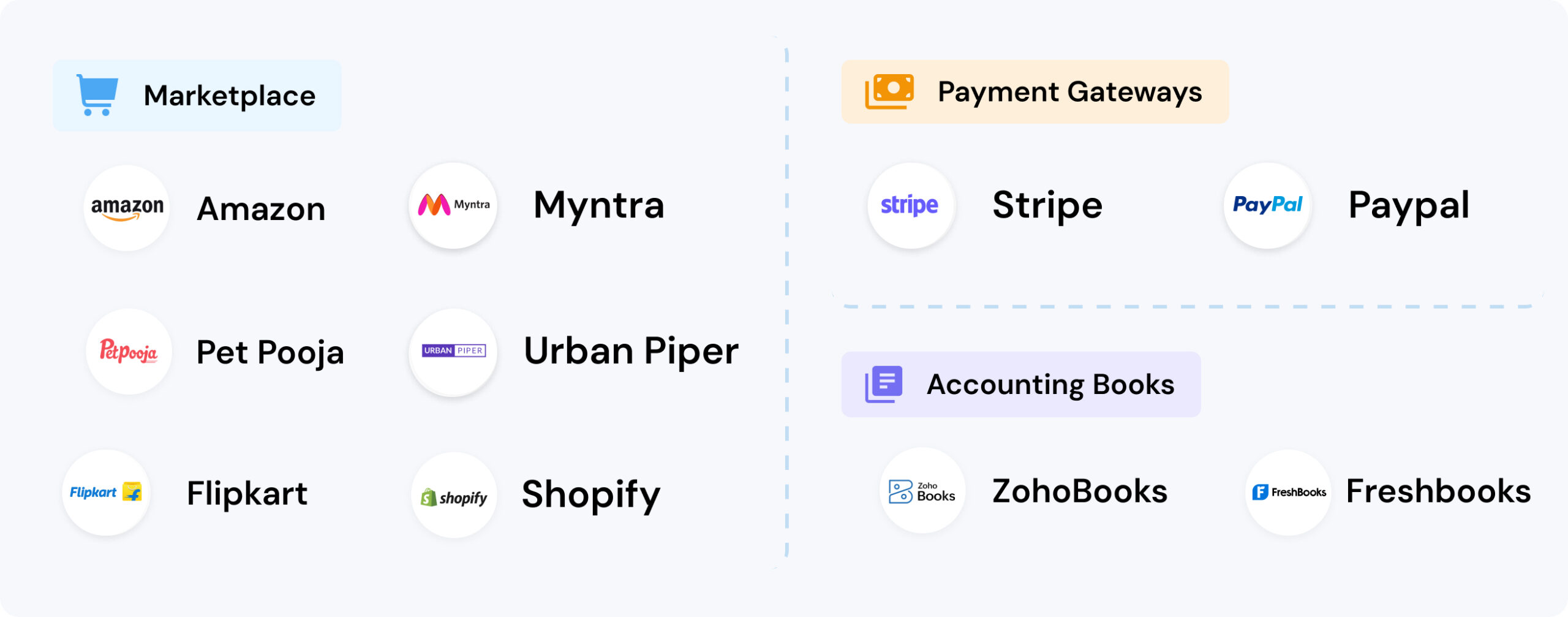

Effortlessly consolidate data from marketplaces, payment gateways, and accounting systems into a unified platform

Minimise reliance on multiple tools and full-time employees by consolidating your financial operations in one place

Say goodbye to seat-based pricing. You’re charged solely based on system usage ensuring maximum value at every stage

Transaction Value Processed

Automated connection sources

Time saved

Less than 10 mins for 20Gb file

Trusted by top finance professionals