Managing Financial Risk in High-Growth Companies: CFO Strategies

High-growth companies face amplified financial risks amid rapid expansion. For CFOs navigating hypergrowth, mastering financial risk management (FRM) is crucial. This guide explores actionable strategies CFOs can deploy to mitigate financial risk, improve cash flow visibility, and leverage AI-driven tools for sustainable growth.

Introduction: Why Financial Risk Management is Critical in Hypergrowth

Financial Risk Management (FRM) is defined by Harvard Business School as “the systematic process of identifying, assessing, and mitigating threats or uncertainties that can affect your organization”. CFOs in high-growth companies face heightened financial risks due to accelerated expansion, rapid capital consumption, and operational complexities. In such volatile environments, strategic FRM can become a powerful competitive advantage, transforming risk into a catalyst for sustainable growth.

TL;DR:

In hypergrowth, risk doesn’t scale linearly—it compounds. As revenue accelerates, so do exposure points across cash flow, compliance, vendor dependencies, and operating complexity. This playbook equips CFOs and finance leaders with the frameworks, AI tooling, and governance strategies to turn financial risk management into a strategic advantage—not just a safeguard.

Key Points:

-

High-growth environments amplify financial risk across liquidity, credit, market, operational, and regulatory dimensions.

-

CFOs must build real-time cash visibility, not monthly snapshots, to avoid working capital surprises and improve capital deployment.

-

Intelligent automation and AI accelerate risk detection—flagging anomalies, matching transactions, and surfacing compliance gaps before they escalate.

-

Financial risk management maturity grows from reactive firefighting to proactive, simulation-based scenario planning—powered by unified data infrastructure.

-

Cross-functional risk governance is essential: siloed risk ownership slows response time and weakens controls.

-

Strategic CFOs don’t just measure risk—they model it, benchmark it, and use it to inform pricing, hiring, and growth strategy.

Understanding Core Financial Risks in High-Growth Companies

In high-growth scenarios, CFOs must address several key financial risks proactively:

1. Credit Risk: Managing Exposure to Customers and Vendors

Credit risk involves the potential loss due to a customer or vendor failing to meet financial obligations. For rapidly scaling businesses, credit risk often manifests in delayed payments or outright defaults, significantly impacting cash flow.

- Real-World Example: High-growth SaaS startups face elevated credit risks, especially when serving small businesses or startups themselves.

- Mitigation Strategy: Implement credit scoring and real-time monitoring tools to promptly flag credit exposure and adjust credit policies.

2. Market Risk: Handling External Volatility

Market risk refers to potential losses from shifts in the overall market environment, including currency fluctuations, commodity prices, or interest rates.

- Real-World Example: A global ecommerce brand experiencing foreign exchange volatility affecting cross-border profitability.

- Mitigation Strategy: Employ hedging instruments and scenario planning software to perform stress-testing, helping finance teams respond proactively to market changes.

3. Liquidity Risk: Maintaining Cash Flow in Rapid Growth

Liquidity risk arises when a company cannot meet its short-term financial obligations due to cash shortages or poorly managed cash flow.

- Real-World Example: Rapidly scaling D2C brands frequently encounter liquidity issues due to inventory mismanagement and delayed customer payments.

- Mitigation Strategy: Deploy real-time cash flow forecasting tools with predictive analytics, allowing CFOs to anticipate cash shortfalls and plan effectively for funding needs.

4. Operational Risk: Navigating Internal Process Challenges

Operational risk encompasses internal process breakdowns, human errors, cybersecurity vulnerabilities, and system failures.

- Real-World Example: Tech startups with manual financial processes are vulnerable to data entry errors, fraud, and compliance breaches.

- Mitigation Strategy: Adopt AI-driven automation to streamline tasks such as invoice processing, bank reconciliations, and financial reporting, reducing manual errors significantly.

5. Legal & Regulatory Risk: Ensuring Compliance Amid Changing Regulations

Legal and regulatory risk involves financial losses resulting from non-compliance or regulatory breaches. High-growth companies operating across multiple jurisdictions face amplified legal complexities.

- Real-World Example: Multinational companies exposed to GDPR fines or regulatory penalties due to inconsistent compliance practices.

- Mitigation Strategy: Utilize AI-powered compliance software that continuously monitors financial reports against regulatory guidelines, ensuring accuracy and timeliness of disclosures.

Strategies CFOs Can Implement for Effective Financial Risk Management

With risk profiles intensifying in high-growth companies, CFOs must pivot from traditional controls to dynamic, data-driven strategies. Below are four proven approaches to help CFOs mitigate risk, improve decision velocity, and sustain growth with confidence.

2.1 Building Robust Data Infrastructure

Fragmented data is the Achilles’ heel of financial risk management. High-growth firms often juggle multiple systems—ERP, CRM, banks, Excel, payroll—without real-time integration.

CFO Strategy:

- Migrate to cloud-native finance platforms with API integrations

- Create a unified data layer that ingests, cleanses, and normalizes financial signals

- Embed governance protocols around data ownership and refresh rates

Outcome:

Faster insights, more accurate forecasts, and a shared source of truth across FP&A, treasury, and leadership.

Example: Leading firms now deploy data lakes to stream real-time financial KPIs from POS systems, invoices, and external sources like FX feeds or economic indicators.

2.2 Leveraging AI and Automation

Manual tasks don’t scale. When 70% of finance time is spent on repetitive work, strategic risk management falls behind.

CFO Strategy:

- Automate workflows such as three-way matching, accrual calculations, and reconciliation

- Use machine learning to identify anomalies, flag outliers, and optimize approvals

- Deploy intelligent document processing (IDP) for extracting data from vendor invoices and bank statements

Outcome:

Reduced human error, faster month-end close, and earlier detection of financial inconsistencies.

Best Practice: Start with 1–2 pilot workflows (e.g., AP invoice processing), define success metrics (error reduction, time saved), and scale via a Finance Automation Center of Excellence.

2.3 Cash Flow Visibility & Optimization

Liquidity is a daily battle in hypergrowth. CFOs need more than monthly reports—they need forward-looking visibility.

CFO Strategy:

- Implement rolling 13-week cash flow forecasts with real-time bank feeds

- Automate alerts for late payments or spend anomalies

- Use predictive analytics to model potential burn or savings scenarios

Outcome:

Improved working capital management, strategic timing of vendor payments, and greater investor confidence.

Insight: Companies using AI-driven tools see 20–30% improvements in forecast accuracy and faster capital deployment decisions.

2.4 Risk Governance and Cross-Functional Collaboration

Risk silos kill response time. In high-growth companies, ownership for financial risk is often dispersed.

CFO Strategy:

- Establish cross-functional risk councils with representation from finance, operations, legal, and tech

- Integrate risk reviews into monthly business cadence

- Use scenario dashboards to simulate “what-if” stressors—e.g., margin pressure, supplier default, or churn spikes

Outcome:

Real-time response capabilities, faster mitigation of threats, and a culture of proactive risk ownership.

Tool Tip: Platforms like Workday Adaptive or Pigment enable collaborative scenario planning and VaR modeling at the business unit level.

Key Takeaway:

Risk management isn’t a report—it’s a muscle. By embedding AI, data, and cross-functional governance into the finance core, CFOs can scale growth without scaling chaos.

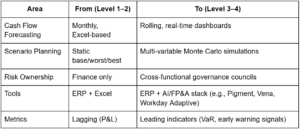

Financial Risk Management Maturity Model for CFOs

Every CFO in a high-growth company grapples with one central question: Are we managing risk fast enough to scale safely? This maturity model offers a practical, CFO-specific roadmap to assess and elevate your financial risk management practices—from reactive patchwork to strategic foresight.

We break this down into four distinct levels:

Level 1: Reactive Risk Management

“We’re flying blind until the damage shows up on the P&L.”

At this stage, risk management is informal, fragmented, and largely post-mortem.

Characteristics:

- Reliance on Excel and disconnected systems

- Cash flow updates occur monthly or less

- Scenario planning is limited to annual budgeting—if done at all

- Risk signals (like overdue receivables or missed forecasts) surface too late

- No formal risk governance or cross-department accountability

Examples of Exposure:

- Surprise liquidity crunch after a big vendor payout

- Customer churn reveals pricing risk—months after the trend began

- Foreign exchange losses realized only during quarter-end true-ups

What to Improve:

- Set up a weekly cash position dashboard

- Introduce rolling 13-week cash forecasts

- Assign basic risk ownership (e.g., AP, treasury, FP&A leads)

Level 2: Systematic Risk Management

“We’ve got reporting flows, but decision latency remains.”

Risk is now recognized as important, but the organization lacks the tools or cadence for proactive action.

Characteristics:

- KPI tracking includes burn rate, gross margins, DSO, and FX exposure

- Some automation for reconciliation and reporting

- Scenario planning is quarterly or tied to board prep

- Risk still siloed within finance; limited collaboration with sales, HR, ops

Examples of Progress:

- CFO identifies margin pressure early through margin waterfall reports

- Late-paying customers are flagged, but follow-up remains manual

- Forecast accuracy improves, but remains delayed by 1–2 weeks

What to Improve:

- Begin cross-functional monthly risk reviews

- Automate receivables monitoring and vendor risk scoring

- Integrate treasury and ERP data for faster close cycles

Level 3: Integrated Risk Management

“Finance owns the dashboard—and the entire org pays attention to it.”

This is where CFOs shift from defenders to proactive architects of resilience.

Characteristics:

- Live dashboards for liquidity, vendor risk, FX, collections, and compliance

- Machine learning detects pattern deviations and flags outliers

- FP&A teams run “what-if” models monthly with cross-functional inputs

- Risk KPIs tied to functional team scorecards (e.g., RevOps, Supply Chain)

Examples of Impact:

- A vendor’s delayed shipment triggers a procurement + FP&A alert

- Scenario planning models simulate impact of losing top 5 customers

- Real-time margin compression alerts influence weekly pricing strategy

What to Improve:

- Build a scenario playbook library (e.g., macro, customer churn, growth stall)

- Define governance cadences: e.g., “trigger threshold = CFO meeting within 48 hrs”

- Tie risk metrics to incentive plans for finance and operating leaders

Level 4: Strategic Risk Management

“We simulate shocks, anticipate downturns, and win investor confidence.”

Risk becomes a strategic moat. Finance isn’t just watching metrics—it’s shaping company decisions in real time.

Characteristics:

- AI-driven simulations run 10,000+ permutations based on live inputs

- Value at Risk (VaR) metrics inform capital allocation and investor decks

- CFO suite operates as a decision engine, not a reporting function

- Risk awareness embedded in OKRs, board narratives, and capital strategy

Examples of Strategic Leverage:

- CFO uses scenario engine to model currency volatility before expansion into Brazil

- Real-time burn alerts help defer a discretionary headcount plan

- Lenders offer better terms based on demonstrated scenario resilience

What to Improve:

- Align your scenario engines with treasury, sales, and pricing tools

- Automate board-ready risk updates with visual dashboards

- Create risk-adjusted funding plans for each new market or initiative

Maturity Progression Guide: Where to Start

Key Takeaway:

High-growth CFOs don’t just react to risk—they institutionalize the systems, tools, and behaviors to see around corners. Progressing up the maturity curve is how finance leaders build resilient businesses and unlock long-term value.

Real-World Examples — Companies Successfully Navigating Financial Risk

Theory matters—but execution is everything. Below are examples of companies that have transformed financial risk from a vulnerability into a competitive advantage. These stories highlight how modern CFOs are turning insights into impact using AI, automation, and integrated finance stacks.

ZenStatement: Bringing Calm to Financial Chaos

Use Case: Streamlining Reconciliation and Decision Support

ZenStatement’s founders understood a fundamental pain point—high-growth finance teams were buried in reconciliations, mismatched ledgers, and delayed cash flow insights. The result? Decision fatigue and profit leaks.

CFO Strategy in Action:

- Deployed an AI-driven platform to automate vendor reconciliation, track cash flow in real time, and surface anomalies before they hit the P&L

- Created a finance stack that integrates smoothly with ERPs and bank feeds

- Enabled CFOs and Controllers to move from reactive close cycles to proactive financial modeling

Results:

- Hours of manual work eliminated per month

- Clear visibility into spend and collections

- Improved margins by reducing revenue leakage from late recognition and invoice errors

Conclusion: Embracing Strategic Risk Management for Sustained Growth

For CFOs of high-growth companies, financial risk is no longer a back-office concern—it’s a front-line lever for strategic advantage. As growth compounds complexity, it also magnifies risk blind spots. The CFO’s role is not just to manage the downside, but to architect resilience into every decision, every forecast, and every financial workflow.

By adopting AI-powered tools, real-time forecasting, and cross-functional governance, CFOs can replace reactive firefighting with proactive control. The goal is not zero risk—but intelligent risk, managed at speed, aligned with business strategy.

Because in hypergrowth, the companies that win aren’t just growing fast—they’re growing smart.

July 26, 2025

July 26, 2025