Introduction

In high-growth ecommerce businesses, reconciliation has evolved far beyond a back-office chore—it’s a boardroom-level priority. With millions of micro-transactions flowing through disparate systems, ensuring every online sale matches your books and bank statement is foundational to financial integrity. Here’s why ecommerce reconciliation should be at the core of every CFO’s operational finance strategy:

TL;DR:

In ecommerce, reconciliation is the backbone of financial clarity. With fragmented systems, FX adjustments, and thousands of micro-transactions flowing daily, every unmatched dollar risks eroding margin, misreporting revenue, or misjudging liquidity. This full-stack reconciliation guide equips CFOs, controllers, and FP&A teams with the workflows, tooling, and data logic needed to match every order to its bank deposit—with speed, accuracy, and audit confidence.

Key Points:

-

Revenue leakage from missed or misclassified transactions can silently shave 1–1.5% off topline—especially in high-volume D2C and marketplace models.

-

Non-synchronous settlements and FX variance distort cash visibility; reconciliation is essential for accurate liquidity forecasting.

-

Clean books and investor trust hinge on automating the full reconciliation stack—from Shopify to Stripe to NetSuite to your bank.

-

Real-time, SKU-level reconciliation enables profitability insight by product, channel, and geography—not just revenue totals.

-

The modern reconciliation stack blends APIs, data transformation logic, and exception-first workflows to eliminate close delays and compliance gaps.

-

Intelligent reconciliation is the foundation for advanced analytics like CAC payback, channel attribution, and working capital optimization.

1. Revenue Leakage Control

Missed, duplicate, or misallocated transactions cause silent revenue leakage—an invisible tax on your margins. In ecommerce, this can stem from gateway errors, untracked refunds, or settlement discrepancies. Ecommerce businesses lose up to 1.5% of gross revenue annually due to reconciliation failures. Proactive reconciliation ensures every cent collected is correctly booked.

2. Reliable Cash Flow Forecasting

Cash received ≠ cash expected. With payout delays ranging from T+2 to T+15, CFOs often face liquidity blind spots. Automated reconciliation aligns payout batches with bank receipts, enabling more accurate daily cash visibility and rolling forecasts—a must in high-burn D2C and inventory-heavy models.

3. Clean Financial Close and Audit Readiness

Messy reconciliation slows month-end close and triggers audit red flags. Manual tie-outs delay reporting, increase compliance risk, and undermine trust in financial statements. An automated ecommerce reconciliation process builds clean audit trails and enables CFOs to meet GAAP, IFRS, and internal reporting standards confidently.

4. Strategic Visibility by Channel, SKU, or Region

Modern finance teams must understand not just how much was earned, but where, when, and from whom. Reconciliation enables SKU-level, region-level, or campaign-level profitability analysis—fueling smarter decision-making across product, marketing, and supply chain teams.

5. Investor-Grade Revenue Integrity

Whether you’re fundraising, preparing for M&A, or reporting to a board, revenue recognition must be rock-solid. Ecommerce reconciliation provides the factual link between order systems, payment processors, and the general ledger—essential for any due diligence process.

Pro Tip for Controllers & FP&A Teams:

Ecommerce reconciliation isn’t just a compliance necessity. It’s an enabler of faster closes, better working capital decisions, and higher investor confidence. It’s also the foundation for advanced analytics like SKU profitability, CAC payback visibility, and channel attribution.

What Is Ecommerce Reconciliation? (And Why It’s More Complex Than Traditional Accounting)

Ecommerce reconciliation refers to the process of verifying that every order placed through an ecommerce platform matches corresponding entries across your payment gateway, merchant account, and bank statement. Unlike traditional retail or SaaS billing, ecommerce finance involves reconciling high-frequency, low-value transactions across multiple fragmented systems. Here’s what makes it uniquely complex:

Definition Breakdown

- Ecommerce Reconciliation = The end-to-end matching of digital sales transactions from ecommerce platforms (e.g., Shopify, Amazon) with payment processor data (e.g., Stripe, PayPal) and final settlement in your business bank account.

- Payment Reconciliation Process = A subset focusing specifically on reconciling payouts and fees from gateways with expected net revenue.

Why Ecommerce Reconciliation Is Harder Than It Sounds

1. Multi-Party Transaction Flow

Every ecommerce sale may involve:

- A customer placing an order on Shopify or WooCommerce

- A payment processed through Stripe, Razorpay, PayPal, or Klarna

- Settlement fees and FX adjustments by the processor

- Net amount deposited in your business bank account

- Journal entries into your ERP or accounting system

That’s 5+ systems per transaction.

2. Non-Synchronous Settlements

Gateways often bundle multiple sales into batch payouts with a 1–7 day lag. Meanwhile, refund reversals or chargebacks might affect separate periods. Without smart reconciliation logic, matching these timelines manually becomes a nightmare.

3. Partial, Failed, or Split Payments

Customers might:

- Abandon mid-checkout

- Pay in installments (BNPL)

- Use wallet credits or gift cards

All of these create partial entries that need careful GL treatment to avoid overstatement of revenue.

4. Revenue Recognition vs. Cash Movement

The revenue event (order placed) and cash event (gateway payout) rarely occur on the same day. Proper reconciliation separates recognized revenue from cash received, maintaining alignment with accrual-based accounting.

Real-World Example:

A Shopify store sells 1,000 units on a flash sale via Razorpay. Gateway fees reduce the net by 2.9%, and settlements hit the bank over three staggered batches. Without reconciliation:

- $12,000 in gross revenue gets recorded

- But $11,652 is received

- And $348 goes unaccounted or misclassified

Impact? Cash flow misalignment, understated fees, and overstated revenue.

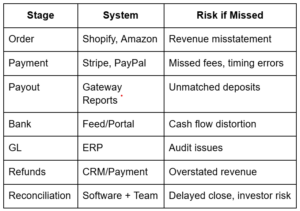

The Full-Stack Ecommerce Payment Reconciliation Process: A Step-by-Step CFO Framework

Reconciliation in ecommerce isn’t a single task—it’s an orchestration across multiple systems and timelines. To master it, CFOs must visualize the entire payment reconciliation process from order placement to bank deposit to GL posting. Here’s the full-stack, step-by-step flow:

Step 1: Order Initiation – Ecomm Platforms (Shopify, Amazon, WooCommerce)

- Trigger Event: Customer places an order online.

- Data Captured: Order ID, SKU, quantity, price, tax, discount codes, shipping.

- Challenge: Orders might be authorized but not captured; returns/refunds may happen later.

Best Practice: Assign a unique reconciliation ID per transaction at order level. Automate tagging of channel, customer, and SKU for later reporting.

Step 2: Payment Authorization – Gateways (Stripe, Razorpay, PayPal, etc.)

- Trigger Event: Payment is processed, authorized, and queued for settlement.

- Data Captured: Transaction ID, authorization status, currency, fees, FX impact, payment method.

- Challenge: Gateways deduct fees upfront, apply FX rates, and aggregate settlements across days.

Best Practice: Extract gateway reports daily via API. Map authorization timestamp to order timestamp to spot timing mismatches.

Step 3: Gateway Settlement and Payout

- Trigger Event: Gateway settles funds in a merchant account (usually T+1 to T+7).

- Data Captured: Net payout amount, fee summary, settlement batch ID.

- Challenge: A single batch may cover hundreds of orders; fees may not be broken down by order.

Best Practice: Build or use a reconciliation engine that can reverse-engineer net payouts into gross revenue + fees + refunds at line-item level.

Step 4: Bank Feed Entry

- Trigger Event: Net funds hit the business bank account.

- Data Captured: Transaction description, amount, date, source (e.g., “Stripe Payout #8943”).

- Challenge: Payouts may hit at different times due to bank holidays or FX delays.

Best Practice: Use automated bank feeds (e.g., Plaid, Yodlee, open banking APIs) to ingest real-time transaction data.

Step 5: General Ledger Mapping and Posting

- Trigger Event: Finance team books journal entries for revenue, fees, taxes, and chargebacks.

- Data Captured: GL accounts, cost centers, SKU or campaign-level tags.

- Challenge: Manual posting leads to misclassification; ERP lags delay visibility.

Best Practice: Define automated GL rules per gateway, channel, and fee type. Use reconciliation software to auto-post clean journal entries into ERP (e.g., NetSuite, Zoho Books).

Step 6: Adjustments, Refunds & Returns

- Trigger Event: Customer cancels, returns product, or files chargeback.

- Data Captured: Refund amount, timing, associated transaction ID.

- Challenge: Refunds may be netted in future payouts; partial refunds complicate GL matching.

Best Practice: Track refunds as discrete reversal entries. Re-tag revenue entries for chargebacks and partial credits to maintain clean P&L views.

Step 7: Final Reconciliation and Month-End Close

- Trigger Event: Finance validates that all revenue booked matches funds received.

- Tools: Reconciliation software (ZenStatement, Bluecopa, Osfin), bank rules engines, exception reports.

- Challenge: Variance reports often span multiple systems and teams.

Best Practice: Use exception-led workflows: only transactions with mismatches or missing data require manual review.

Quick Summary: Ecommerce Reconciliation Flow

The Real Risks of Poor Reconciliation in Ecommerce Finance

Without a robust ecommerce reconciliation process, finance teams expose themselves—and their companies—to operational, financial, and reputational risks. Below are the six most critical failure points, each with real-world CFO consequences:

1. Revenue Overstatement or Duplication

- Impact: Inflated top-line metrics, misleading board/investor updates, risk of clawbacks.

- Cause: Failing to back out refunded or duplicate transactions from revenue.

Insight: Audit-ready companies never recognize revenue without reconciliation proofs. Use SKU-level matching to spot duplicates.

2. Unexplained Variances Between ERP and Bank

- Impact: CFOs lose trust in their financial model. Treasury projections become unreliable.

- Cause: Delayed gateway settlements or FX misalignments.

Insight: Real-time payout reconciliations improve working capital forecasting accuracy by 20–30%.

3. Missed Chargebacks and Refund Reversals

- Impact: Negative customer experience, misclassified losses, underreported costs.

- Cause: Refunds processed without triggering GL reversals.

Insight: A single chargeback miss can understate customer churn and inflate LTV metrics.

4. Slower Month-End Close

- Impact: Delays in P&L finalization, board reporting, and cash flow forecasting.

- Cause: Manual CSV-to-ERP tie-outs, unclear exception handling.

Insight: Best-in-class finance teams cut close cycles by 50–70% with reconciliation automation.

5. Non-Compliance With GAAP or IFRS

- Impact: Regulatory exposure, failed audits, or financing delays.

- Cause: Recognizing revenue on order date, not payout receipt; missing refund offsets.

Insight: CFOs should align reconciliation logs with revenue recognition principles and retain timestamped audit trails.

6. Erosion of Investor and Board Confidence

- Impact: Lower valuations, reduced trust, financing risk.

- Cause: Inconsistent financial data during due diligence or investor updates.

Insight: Clean, auditable reconciliation processes are a confidence signal to private equity, VCs, and public investors.

Would you like me to continue with:

- “Root Causes of Reconciliation Complexity”

- “Reconciliation Maturity Model for Ecommerce Businesses”

Root Causes of Reconciliation Complexity in Ecommerce Businesses

Ecommerce may seem seamless to the customer—but behind the checkout lies a maze of systems, timelines, and transaction layers that complicate financial reconciliation. For CFOs and Controllers, understanding these friction points is key to streamlining operations and eliminating financial risk.

1. Multi-System Fragmentation

Most ecommerce businesses operate across 5–10 disconnected systems:

- Front-end: Shopify, WooCommerce, Magento

- Payment Gateways: Stripe, PayPal, Razorpay, Square

- Banking: Multiple business accounts, often across countries

- ERP/Accounting: QuickBooks, NetSuite, Zoho Books

- Shipping, CRM, Returns: Gorgias, Loop, ShipBob

Each system holds a slice of the transaction story, but none talk natively to one another.

Example: A $120 order in Shopify may be split across Stripe (payment), Razorpay (refund), and bank (settlement) — none of which share a common transaction ID.

Suggested read : How ZenStatement Solves for Ecommerce Reconciliation

2. Delayed or Non-Uniform Payout Cycles

Different gateways follow different payout frequencies:

- Stripe: T+2 rolling

- PayPal: Instant or 7-day hold

- Amazon: Biweekly

- Klarna/BNPL: After fulfillment or customer payback

These non-standard cycles cause timing mismatches between revenue recognition and cash receipt, complicating month-end close.

Fix: Align ERP revenue logic with payout schedules using batch-level reconciliation.

3. Foreign Exchange (FX) and Cross-Border Fees

Cross-border ecommerce adds currency conversion and fee volatility:

- FX spreads are dynamic

- Settlement currency ≠ transaction currency

- Refunds may occur in different exchange rates than original sale

CFO Tip: Reconcile in transaction currency, then apply a layered FX revaluation policy to protect margin reporting integrity.

4. Partial, Split, and Failed Payments

Customers increasingly use:

- Gift cards

- Wallet balances

- Partial BNPL payments

These result in:

- Split settlements

- Deferred revenue events

- Mid-checkout drop-offs

Fix: Use reconciliation tools that support multi-line, multi-source mapping (e.g., Stripe + wallet + coupon = one order).

5. Manual Processes and Human Bottlenecks

Many finance teams still rely on:

- Excel VLOOKUPs for matching

- CSV downloads from each gateway

- Email chains for exception tracking

This leads to:

- Error-prone reporting

- Slower month-end close

- Lost institutional knowledge when team members churn

Strategic CFO Move: Replace manual tie-outs with an exception-first, rules-based reconciliation engine integrated with ERP and bank feeds.

Ecommerce Reconciliation Maturity Model: Benchmark Your Finance Ops

Not every business needs real-time reconciliation from day one—but knowing where you are and what to aim for is critical. Below is a four-tier maturity model that helps ecommerce finance teams benchmark their current reconciliation process and define a future-ready roadmap.

Level 1: Manual Reconciliation (The Startup Struggle)

How It Works:

- Finance teams export CSVs from Stripe, Shopify, PayPal

- Manual matching with Excel formulas

- Reconciliation takes 5–10 days post-month-end

Symptoms:

- Inconsistent numbers across reports

- Frequent variance write-offs

- Board decks manually compiled

Risks:

- High error rates

- Missed chargebacks

- Audit red flags

Level 2: Semi-Automated Reconciliation (Emerging Operator Stage)

How It Works:

- Some API pulls from Stripe or PayPal

- Accounting platforms (e.g., QuickBooks + Synder or Zoho + Razorpay) used

- Spreadsheets still required for exceptions

Symptoms:

- Faster close (~5 days) but growing complexity

- Finance team overwhelmed by SKU-level reporting

- Hard to scale with new channels

Risks:

- Increasing data latency

- Limited granularity

- Poor visibility into product/channel margins

Level 3: Integrated Reconciliation (Growth-Stage Finance Org)

How It Works:

- Automated daily reconciliation across gateways, ERP, and bank

- Fee mapping, FX adjustments, refund tagging built-in

- ERP auto-posts clean journal entries

Symptoms:

- Reliable weekly close

- 90% of transactions reconciled automatically

- CFO dashboard with real-time payout vs revenue insights

Benefits:

- Reduced manual work

- High audit confidence

- Cash forecasting accuracy improves

Level 4: Intelligent Reconciliation (AI-Driven, Real-Time Ops)

How It Works:

- Reconciliation engine uses machine learning to match partials, detect anomalies, and auto-categorize exceptions

- Real-time alerts for missing deposits or late settlements

- Fully embedded into the ERP/FP&A workflow

Symptoms:

- Near-instant insight into reconciliation health

- Team focuses on strategy, not number crunching

- Custom reporting by SKU, channel, geography

Strategic Advantage:

- Scales to multi-entity, multi-region operations

- Sets foundation for AI-led forecasting and cash optimization

- Board-level visibility into revenue certainty

Best Practices for Ecommerce Reconciliation

Reconciliation in ecommerce finance isn’t just about keeping the books clean—it’s about building a resilient, insight-rich operation that can scale with speed and complexity. As transaction volumes grow and payment rails fragment, traditional approaches like spreadsheet-based matching or post-facto adjustments become both risky and inefficient. To stay ahead, CFOs and Controllers must hardwire a set of scalable reconciliation practices into their finance operations. Here’s how to do it right.

Adopt a Daily Reconciliation Cadence

Instead of waiting until month-end to reconcile transactions, leading finance teams adopt a daily rhythm. This doesn’t mean closing the books every day, but it does involve reviewing settlement reports from gateways, matching payouts to expected orders, and resolving discrepancies in near real-time. This proactive cadence minimizes backlog, enables faster exception handling, and gives treasury teams accurate data for cash forecasting and liquidity planning.

Tag Transactions at the Source

Accurate reconciliation starts at the first touchpoint. By tagging each transaction with key metadata—channel, SKU, campaign, fulfillment location, and payment method—finance teams can track the full journey of each dollar across systems. This upfront data discipline creates downstream clarity, enabling more precise revenue recognition and granular profitability analysis.

Use Threshold-Based Matching Rules

Perfect one-to-one matches are rare in ecommerce, especially when foreign exchange fees, rounding variances, or gateway adjustments are in play. Rather than forcing perfection, modern reconciliation tools use tolerance thresholds to automatically match entries that fall within acceptable variance bands. This approach speeds up the process while focusing human attention on true anomalies.

Integrate Reconciliation Into Financial Workflows

Reconciliation data should not be siloed—it must flow into the broader financial infrastructure. This includes feeding revenue schedules, updating AR aging, triggering alerts for missed settlements, and enriching dashboards with payout certainty metrics. When reconciliation is embedded into the FP&A rhythm, it transforms from a retrospective task to a strategic visibility engine.

Treat Reconciliation as a Living System

As your ecommerce stack evolves—new payment options, more regions, dynamic pricing—your reconciliation logic must evolve too. Review rules regularly, audit exception logs, and update gateway integrations as needed. Treat reconciliation like a core financial system: not a one-time setup, but a continuously improving capability.

How to Choose the Right Ecommerce Reconciliation Tool

For finance leaders, selecting the right reconciliation software isn’t just a tooling decision—it’s a systems architecture choice that determines how scalable, auditable, and insight-rich your operations will be. A good tool eliminates busywork. A great one creates confidence, reduces time to close, and turns reconciliation into a strategic lever. Here’s what to look for when evaluating your options.

Ensure Native, Multi-System Integrations

The most fundamental requirement is seamless integration across your ecommerce stack. Your reconciliation tool should plug directly into your storefronts (like Shopify or WooCommerce), payment gateways (such as Stripe, Razorpay, and PayPal), bank feeds, and ERP or accounting systems. Native integrations reduce the need for CSV uploads, eliminate manual syncing, and ensure continuous data hygiene across the board.

Prioritize Flexible Data Mapping and Transformation

Ecommerce payments aren’t always straightforward. You’ll encounter split payments, wallet credits, FX conversions, and refunds that span multiple periods. Your reconciliation software should allow flexible mapping logic—transforming raw inputs from gateways into accurate revenue and fee classifications that match your internal GL and reporting structure.

Demand Transparent, Auditable Workflows

A high-performing reconciliation engine provides more than matches—it gives you a trail. Every match, exception, and override should be logged, timestamped, and auditable. This level of transparency is essential not only for internal governance but also for external audits, investor due diligence, and regulatory compliance. It protects your finance team and boosts credibility with stakeholders.

Evaluate the True Cost of Reconciliation

Beyond subscription fees, consider the total cost of reconciliation: staff hours spent on manual matching, delayed closes, errors fixed retroactively, and missed insights. Tools that automate even 80–90% of the process can yield exponential ROI by freeing up finance bandwidth for analysis, scenario modeling, and strategic planning.

Select Vendors Who Understand Ecommerce Finance

Not all reconciliation platforms are built with ecommerce in mind. Look for vendors with deep domain expertise—teams that understand order vs. payout timing, SKU-level profitability, and channel-based reporting. These platforms will come with pre-built logic for common ecommerce edge cases, making implementation smoother and performance more reliable.

The Strategic Payoff of Ecommerce Reconciliation Automation

Modern finance teams can no longer afford to treat reconciliation as back-office hygiene. When automated and integrated, it becomes a core operational advantage. Below are four high-leverage outcomes CFOs can expect from investing in reconciliation automation.

1. Faster, Cleaner Financial Close

Automated reconciliation reduces dependency on month-end batch processes by clearing 90–95% of transactions in real-time. This shortens close cycles, eliminates last-minute firefighting, and creates space for higher-value tasks like variance analysis and scenario modeling.

2. Real-Time Revenue Visibility

When reconciliation data syncs daily across gateways, bank feeds, and ERPs, finance leaders gain continuous visibility into earned revenue, cash-in-transit, and payout delays. This enables tighter cash management, improves liquidity forecasting, and supports faster business pivots.

3. Audit-Ready Books at All Times

Automated systems generate a full audit trail—timestamped, source-linked, and anomaly-flagged. This not only reduces compliance risk but also instills confidence with auditors, investors, and boards. During M&A or fundraising, being able to trace revenue back to source in seconds is a credibility multiplier.

4. Reduced Manual Overhead and Error Risk

Eliminating CSV downloads, VLOOKUP matching, and manual data entry saves hundreds of hours annually. It also reduces the risk of errors that lead to revenue misstatement, missed chargebacks, or reporting inconsistencies.

Conclusion — From Accounting Task to Growth Enabler

Ecommerce reconciliation is no longer a routine accounting chore—it’s infrastructure. It connects order systems, payment flows, and financial reporting in real-time, ensuring every dollar is accounted for and every metric is trustworthy.

In a world where ecommerce is real-time, multi-channel, and global by default, finance leaders must match that pace with equally real-time controls. Reconciliation automation doesn’t just remove friction; it creates leverage.

What great finance teams understand:

Reconciliation is not about ticking boxes. It’s about protecting revenue, enabling agility, and building trust in your numbers. Treat it as such, and it becomes a catalyst for scale—not a blocker to it.

July 27, 2025

July 27, 2025